Despite challenges, India’s RE sector surges on

Binit Das

As part of the Paris Agreement, India pledged to build 175 GW of renewable energy capacity by 2022 and achieve about 50 percent cumulative electric power installed capacity from non-fossil fuel-based energy resources by 2030. Additionally, the country committed to reducing the carbon intensity of its economy from 35% in 2005 to 45% by 2030.

However, owing to the pandemic in 2020, things were not easy even for the RE sector, which witnessed a reduction in global energy demand, which in turn affected investments in renewable energy (RE).

As of December, 2022, India's installed renewable energy capacity exceeded 120GW. The country ranked fourth globally in terms of installed renewable energy capacity.RE installations increased in the June 2021 quarter, following a slowdown in Financial Year 2019/20.

Fig: Electricity indicators in India, 2010-2021

Fig: Annual change in electricity indicators in India, 2021 and average 2015-2020

Despite a remarkable growth in capacity additions and universal access to electricity, Covid-19 has exacerbated a pre-existing slump in investment and demand.

Fig: Daily electricity demand in India in 2019 and 2040

India has a lot of promise when it comes to renewable energy. The entire potential for solar power is expected to be 748 GW, according to the National Institute of Solar Energy (NISE). Solar power has an installed capacity of roughly 62 GW,) which is less than 8% of the entire potential. Solar power accounted for only 52% of the country's total renewable energy capacity (120 GW) as of December, 2022. (See Figure 7: Status of grid-connected renewable energy in India).

Table: Potential for renewable energy sources

Fig: Status of grid-connected renewable energy in India (GW)

Fig: India's Installed Capacity (GW)

Fig: India's Power Generation Capacity (BU)

India's new commitment

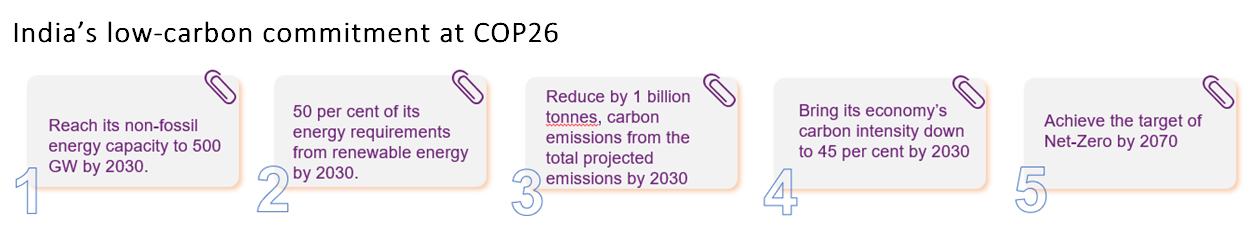

At COP26, Prime Minister Narendra Modi announced enhanced targets for India to combat climate change. One significant change from the PM's declaration is that 50 per cent of the installed power capacity target will now be derived from non-fossil sources.

This year, on August 3, 2022, the Union Cabinet approved India's updated climate pledge to the Paris Agreement in achieving about 50 percent cumulative electric power installed capacity from non-fossil fuel-based energy resources by 2030.

Challenges ahead

The solar segment accounts for 62 percent (280GW) of India's promised 450 GW by 2030 to meet the target we need to install 27 GW of solar capacity each year at the current rate. According to data from the CEA, we added only 11 GW of solar energy capacity in 2021 and 8 GW till Dec 2022.

As per data from the CEA, of the 100 GW solar target (from the overall 175 GW RE target) set by 2022, 60 GW has to come from utility-scale ground-mounted solar and 40 GW needs to come from rooftop solar.

Secondly, our solar business is strongly reliant on imported solar panels, modules, and other accessories, which have increased in price by 20% to 25% since the epidemic began. India imported USD 2.5 billion worth of solar wafers, cells, modules, and inverters before the epidemic (in 2019-20). The Union Ministry of New and Renewable Energy (MNRE) had, in March 2022, allocated Rs 4,500 crore to support the manufacture of high efficiency solar photovoltaic (PV) modules by providing PLI on the sales of such modules.An additional outlay of Rs 19,500 crore was also announced in the Budget 2022-23 February 1, 2022. The production linked incentive (PLI) scheme would help in building a huge domestic manufacturing base. This would be not only for cells and modules, but also polysilicon and wafers which was missing in the Indian market.

Solar net-metering is discouraged by power distribution companies (discoms) in various states for fear of losing revenue and becoming financially unviable. India requires a unified strategy for acquiring solar energy that is both consumer- and investor-friendly.

Moreover, due to protests from locals and environmentalists about their negative influence on the local ecology, some solar ground-mounted projects have fallen into difficulties. It would be beneficial if the objective for rooftop instalments was increased from the current 40% to say 60%, given that there would be no opposition. Rooftop solar installations, according to energy experts, are more environmentally friendly and have the potential to create thousands of jobs, apart from stimulating entrepreneurship.

Challenges for RE Integration

There are significant challenges that the country faces, when it comes to meeting the 2030 target for the RE sector. While some of these challenges are already a reality for certain states, other states are likely to face them depending on their current level of RE penetration.

Following are the most important short- and medium-term challenges that many states will face:

- As solar and wind sites are concentrated in certain regions within states and in certain states within India, transmission challenges include new bottlenecks within states and limited capacity available across states (interstate transmission lines).

- Solar and wind generation data are often unavailable in many states, and forecast accuracy must improve. Regulations often allow for forecast errors of 15%, which for Karnataka could mean more than 1,000 MW of renewable generation deviation at certain times.

- The curtailment of solar and wind power is posing a challenge as well as offering a solution for managing the power system in emergency situations. While solar and wind power have must-run status in most states, these sources are often secondary to hydropower or coal generators.

- There is a lack of flexibility and standard operating procedures at the state level for existing coal generation plants, and ramping requirements are rising.

- The inertia in India has slightly declined in recent years at certain times due to a decline in system strength, increasing fluctuations in frequency and voltage levels in certain regions, and increasing frequency fluctuations.

RE Initiative for energy intensive sectors

Indian Railways: The Indian Railways, the fourth largest railway network in the world, seeks to become a Green Transporter by reducing its carbon footprint. In FY 2020, Indian Railways consumed 18,410 million units of energy for traction and 2,338 million units for non-traction.

Indian Railways has taken significant steps to reduce its carbon footprint & fuel costs and is on track to become a 'net-zero' carbon emissions organization by 2030. A few of its key initiatives towards decarbonization include 100% electrification of Railways broad gauge network, reducing energy consumption, and using renewable energy sources to meet energy demands. Currently, Indian Railways has a capacity of 220 Megawatts (MW) of renewable energy, with another 3,450 MW under construction.

Indian Railways invited bids to determine if hydrogen can be used to power diesel-fuel trains.

Steel: Steel has been the backbone of the Indian economy since Independence. In 2019, India produced 111 million tonnes (Mt) of steel, making it the second-largest producer of steel in the world after China.According to the National Steel Policy, 2017, India will produce 300 Mt of steel annually by 2030. The steel industry is committed to reducing emissions and reducing the impact of its operations on global climate change. According to the NDC of the steel industry submitted to the Ministry of Environment, Forest and Climate Change, the average CO2 emission intensity of the Indian steel industry is projected to fall from 3.1 T/tcs in 2005 to 2.64 T/tcs by 2020 and 2.4 T/tcs by 2030. (i.e., approx. 1% per year).

Fertilizers: According to India's draft hydrogen policy, refineries and fertiliser plants will gradually utilize green hydrogen instead of fossil fuels. According to a government source, the draft policy calls for green hydrogen to account for 10% of the overall hydrogen needs of refineries by 2023-24, rising to 25% in five years. The fertilizer sector's requirements are 5% and 20%, respectively. Utilizing green hydrogen would reduce imports of ammonia and natural gas needed for fertilizer production.

The Indian Oil Corporation Limited (IOC) announced plans to build the first-ever commercial green hydrogen plant at its Mathura refinery in Uttar Pradesh in July, as the country has already begun using and producing green hydrogen.

Cement: With a capacity of 500 MTPA, India is the world's second-largest cement producer, contributing roughly 30% of the sector's emissions. Cement manufacturing generates emissions from chemical processes and fossil fuel burning. Therefore, we must find ways to minimize emissions and optimize energy consumption.

As of 2018, Dalmia Cement announced that it aimed at becoming carbon-negative by 2040. Since then, it has taken several measures, including increasing its use of renewable energy and experimenting with carbon capture and utilization. This year, ACC Limited introduced a ready-to-use green concrete mix that contains 30% to 50% less carbon than conventional Ordinary Portland Cement.

Cross border electricity trade; GGI-OSOWOG: The “Green Grids Initiative - One Sun One World One Grid” (GGI-OSOWOG), aims to harness solar energy and transport the electricity generated to areas that need it. There will be three phases to the grid's development---The 'Indian Grid' will in the first phase be interconnected with Middle East, South Asia, and South-east Asia grids so that solar and other renewable energy resources can be shared during peak demand periods. In the second phase, it will be connected with the African power pools, and in the third phase, global interconnection of the power transmission grid will be completed. Estimates suggest that global interconnection capacity could reach almost 2600 GW by 2050, slashing energy costs by about 226 billion Euros per year.

The idea of regional grids is not new---there is Australia-Singapore's energy sharing program; China's GEIDCO hopes to connected Asia, Europe and Africa by 2035 with an inter-continental grid; and Nord Pool, which connects Scandinavian countries. Nevertheless, OSOWOG will create the first global network dedicated to solar energy.

Prime Minister Narendra Modi first outlined the concept of OSOWOG at the First Assembly of the International Solar Alliance in late 2018.As part of the COP26 climate summit in Glasgow, the US has partnered with the UK and India to create a global energy grid called Green Grids Initiative.

Even though the project can be considered India's bid for world leadership, OSOWOG threatens to be a complex, expensive undertaking. In a world of geopolitical uncertainty, the prospects of a single grid are remote. In addition, disruptions could potentially affect critical services in multiple regions, continents, and countries. Also, building political consensus among 140 countries could be difficult.

In a region such as South Asia, where population density, and therefore energy demand, varies widely, it is difficult to maintain a stable grid over a large geographical area with high energy demand. Any grid needs a constant base load, or a minimum flow of electricity, at all times. A bigger grid becomes more difficult to stabilize with a steady electricity current because it will experience demand peaks and drops at different times.

Recent distribution reforms: To ensure investment as well as returns for investors, India requires an efficient energy chain that focuses on power delivery and a regulatory framework that ensures an adequate flow of investments. The weakest link in this chain is the electricity distribution network, which is both financially ailing and inefficient. Power tariffs often do not reflect costs. Transmission losses of 22% are three times the global average, while mounting losses of distribution companies (discoms) amount to ₹90,000 crore. This has a cascading effect on the power sector.

According to the Payment Ratification and Analysis in Power procurement for bringing Transparency in Invoicing of generators (PRAAPTI) portal, distribution companies owe power-generating companies ₹1,32,432crore as of June 2022, both for conventional energy and renewable energy. The Electricity (Amendment) Bill, 2022 was introduced in Lok Sabha in August 2022.It has been referred to the Standing Committee on Energy for detailed examination.As is the case with telecom service providers, the Bill proposes delicensing of the distribution sector to promote competition and to provide consumers with choice. Furthermore, it proposes other measures that will bring transparency, accountability, and efficiency by addressing four key areas:

- De-licensing of distribution & portability: Currently, discoms work as monopolies in their territories. The Amendment Bill would allow multiple companies to operate in a region, bringing in more competition and private participation. With the reduction of entry barriers, it may attract large private-sector investments in the distribution space and relieve the latter's distress. For consumers, it will increase portability similar to the telecom industry. In spite of this, the process may not be as smooth since the current discom will retain ownership of the network.

- Strengthening of the despatch centre: Load Despatch Centres will be empowered to halt all schedules and despatches if payment guarantees have not been provided by the discom. Accordingly, it is expected that discoms will be required to submit relevant payment securities in accordance with their Power Purchase Agreements (PPAs). In a few cases, renewable energy developers have not submitted payment securities from their counterparties. This will also provide comfort to lenders and increase the bankability of PPAs.

- Reinforcement of climate agenda: The bill empowers SERCs to fix target Renewable Power Obligations (RPOs) and provides penalties if those targets are not met. In 2019-20, only four states—Andhra Pradesh, Karnataka, Rajasthan, and Tamil Nadu—met their target RPOs. Seven other states achieved over 55% compliance with RPOs. Penalties, even if nominal, would help create a large demand for renewable energy in a few years. In addition, it gives investors an assurance across the value chain for renewable energy.

- Institutional reforms for regulatory bodies: Several institutional reforms that have been introduced, including the strengthening of the Appellate Tribunal for Electricity by adding members, are likely to speed up r pending petitions and reduce queues. The appointment of a member with a legal background will ensure that legal disputes are resolved quickly. By bringing in efficiency, along with a more structured and transparent dispute resolution process, both amendments will enhance the investor’s confidence.

The amendments seek to improve the efficiency of discoms, therefore, their buy-in is crucial to the implementation of these amendments. They also create a complex maze of challenges for them. Discoms that are already struggling with operational issues, may need to strategize for the upcoming challenges.

Among other things, a successful reform will rely heavily on ensuring quality players register as discom licensees. It also means introducing logical penalties for discoms that don't meet their RPO targets since they don't have sufficient renewable energy sources in their stateand largely depend on the bilateral purchase of green electricity.

Rooftop Solar PV and the DRE Market in India: Unlocking the Potential

The Rooftop Solar Photovoltaic (RTS) sector plays a critical role in achieving India's ambitious renewable energy targets by 2022 and beyond. However, the development of residential, commercial and industrial solar PV applications has been slower than that of utility-scale solar PV.As a result of policy, regulatory, and administrative challenges at the central and state levels, as well as limited financing options and reluctance of utility distribution companies, rooftop installations are not expanding as quickly as they should.

We aim to answer six key questions regarding the expansion of RTS in India. The following quick-effect solutions (presented below), could accelerate the deployment of RTS within the next couple of years. Moreover, they do not require structural changes to the regulatory frameworks that exist at the state or central level.

Enhancing economic incentives for Discoms to support RTS deployment: Promotion of Discom-led business models will help aggregate customer demands for RTS systems by leveraging the former’s relationships with customers. Developing methodologies to assess RTS benefits in Discomgrids and enhancing central performance-based incentives for Discoms are some of the other measures that could help expand RTS to a large extent..

Improving access to finance options for consumers interested in RTS investment: By increasing the involvement of private and public institutions in providing affordable loans and guarantees, standardizing the processes for assessing and approving RTS loan applications, and simplifying the rules of sectoral lending programs, will improve access to finance options for those who want to invest in a rooftop solar plant.

Implementing net and gross metering rules to balance system integration and remuneration: This includes increasing the limits on the system capacity without jeopardizing grid stability, as well as balancing the revenues of RTS owners and levies for grid utilization.To promote self-consumption, new remuneration rules should be designed to ensure an attractive return on investment across all consumer segments.

Streamlining disbursement of subsidies and the overall investment process for small RTS: Relaxing requirements for residential consumers to avail subsidies, reducing Discom responsibilities in promoting RTS, disbursing subsidiesand simplifying the investment process from the consumer's perspective will help enhance investment in the RTS sector

Promoting RTS among residential/ small and medium-sized enterprise (SME) consumers and increasing their confidence in RTS: Expansion of education campaigns, simplification of administrative procedures, effective promotion of high-quality equipment and services will help boost the confidence of consumers in RTS.

Both Discoms and RTS owners will benefit from the above-mentioned proposed actions. DIscoms will be rewarded for adopting RTS within their operational area. Policies that facilitate the implementation of existing rules and provide affordable financing will increase consumers' interest. Policies should be such that they offer attractive remuneration to RTS owners while providing enough revenues to Discoms to maintain distribution grids and prepare the necessary infrastructure for expansion of RTS.

System operation, the design of electricity markets, and energy policy require new approaches: Implementation of harmonised rules for supporting RTS across the country, facilitation of an open-access power procurement for RTS systems, promotion of rooftop projects through building codes and city planning procedures, reducing cross-subsidies in electricity tariffs while protecting vulnerable consumers through other means is what the policymakers need to aim for.

Electricity market reforms in India should be comprehensive, aiming to integrate all Decentralised Renewable Energy systems (Mini-Grids) into National Electrification Planning and prepare the Indian electricity system for a broader use of electric vehiclesand battery storage. Experiences from highly advanced power markets suggest that to reap the full benefits of DRE, structural changes are required. These include dynamic tariffs and demand-driven, market-based management techniques, and enabling participation of DRE in short-term balancing markets. The long-term policy should also encourage grid investments; digitalization; widespread deployment of smart, real-time meters; and the development of advanced capabilities for dynamic system control, analysis, modelling, and forecasting. With the further integration of DRE, India will be able to create an efficient power system of the future.

The Indian government has already taken significant steps to create a favourable environment for the development of RTS.A provision of total central financial support of Rs 11,814 Cr, including service charges to the implementing agencies, has been made under the Phase II programme, which was initially scheduled for completion by 2022. However, a total of 7.3 GW RTS capacity has been achieved till 30.11.2022.

As observed in other countries, the introduction of limited changes to existing policies and regulations, and their implementation, could substantially accelerate the growth of RTS capacity.The success in enhancing the adoption of RTS could be the cornerstone for building a new, sustainable, reliable, secure, and more efficient Indian power system powered by DRE.

Share this article